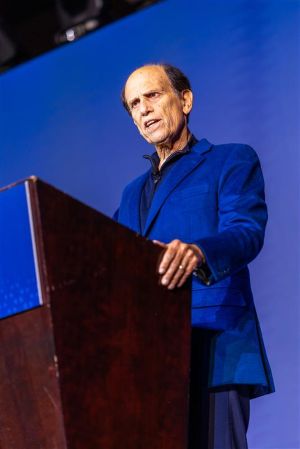

When financier and philanthropist Michael Milken took the stage before a room of eager global chief executives at YPO’s Global Business Summit in Los Angeles, he began with a deceptively simple premise: There are five forces shaping the future. They are, in his words, “human capital, financial markets and entrepreneurs, disintermediation, demographics and the American dream.” He then made the case that all five are intertwined — and that leaders who focus on developing human potential will create the most enduring value.

The birth of an idea

Milken traced the origins of his philosophy back to 1965, when Los Angeles was on fire during the Watts riots. Then a Berkeley student home for the summer, he met a young man who told him his father couldn’t get a loan to build his business because of the color of his skin. That moment, Milken says, reshaped his life and inspired him to write a formula for prosperity: financial capital multiplied by human, social and real assets.

“Financial capital serves as a multiplier on human capital,” he says. “But without education, opportunity and health — the true assets — capital alone cannot create prosperity.”

Human capital as the true engine of growth

Milken describes human and social capital as the world’s largest assets, worth an estimated USD1,500 trillion to USD2,000 trillion in the U.S. alone, compared to USD50 trillion in financial assets. He points to examples like Singapore, which transformed itself from a small island nation to one of the richest countries in the world by betting on education and talent rather than natural resources.

“No one confuses Jamaica and Singapore today,” he says. “Singapore invested in people.”

Leadership, talent and the power of one person

Milken underscores how leadership and vision can transform organizations, contrasting Sony, once a dominant player, with Apple — a company on the brink of bankruptcy in 1997 until Steve Jobs returned. “It takes more than 20 Sonys to make one Apple today,” Milken notes. “The difference was one person.”

For leaders, the message was clear: the most important investments aren’t on the balance sheet. “The only industry that counts people as assets is professional sports,” he quips, “but every business depends on human talent.”

Education, immigration and health: The building blocks

How do you grow human capital? Milken offers three answers: education, immigration and health.

He emphasizes the transformative power of early education, referencing Nobel laureate James Heckman’s research showing that investments in children aged 0–6 yield the highest returns. He also highlighted America’s historic reliance on immigration to fuel innovation, noting that more than half of scientists and engineers in Silicon Valley were born outside the U.S.

“The movement of people is the largest transfer of value in the world,” he says. “Everywhere, the story of prosperity is the story of talent moving to where opportunity exists.”

Health, Milken adds, has driven more than half of global economic growth over the past two centuries. Advances in public health and medical research have added 40 years to life expectancy in just over a century. “Four million years of evolution gave us 31 years of life expectancy,” Milken told the audience of business leaders. “In the last 125, we added 40 more.”

Disintermediation: Every industry, every leader

From finance to media to medicine, Milken warns that no business is immune from disintermediation — the cutting out of middlemen. He points to Netflix and Blockbuster as the textbook case: when Blockbuster passed on buying Netflix for USD50 million, they misread the future. “They thought the most valuable real estate was physical,” Milken says. “It turned out to be digital.”

He also cites the transformation of health care, where sequencing a human genome that once cost USD3 billion now takes a few hours and less than USD150. “AI isn’t coming,” he says. “It’s here — and it’s more accurate at diagnosis than doctors.”

Demographics: The new global divide

Milken’s tone shifts when discussing demographics. He paints a world split between aging nations and youthful regions. Japan and China are shrinking, while Sub-Saharan Africa and India are surging. “There are more children born in Nigeria each year than in all of Europe,” he notes. “If we don’t create opportunities there, nothing else will matter.”

Immigration, he argues, will remain essential for countries like the U.S., where birth rates are below replacement. “Without immigration,” Milken warns, “the U.S. would lose 15 to 20% of its population by the end of the century.”

The American dream reimagined

Milken closed on a personal note. The American Dream, he says, is not about wealth but mobility — the belief that anyone can rise through effort and ability. But he cautioned that belief has waned in parts of the developed world.

“Freedom remains essential to the American Dream. But only 16% of people now equate that dream with becoming wealthy. For many, it’s about purpose — coaching your daughter’s soccer team or creating opportunity for others.”

But rather than turn to nostalgia, Milken ended with optimism. “What made America unique wasn’t just opportunity,” he says, smiling. “It was that you didn’t just have one chance — you had many.”

As the applause rose and the room of chief executives rose to their feet, the message Milken left them with transcends markets: The future belongs to those who invest in people, not just portfolios.